UK-based FinTech firms received 80% less VC funding than their German counterparts throughout Q2 2016.

According to CB Insights and KMPG’s “The Pulse of FinTech” Q2 2016 report, venture capital-backed FinTech firms in Germany saw more than an 80% increase in funding than those in the UK – with notable deals going to startups including N26 and Finanzcheck.

Given global market uncertainties associated with political events such as the UK’s Brexit vote and the upcoming US presidential election, the report notes that it was not surprising that venture capital investors refrained from making significant investments in the FinTech space.

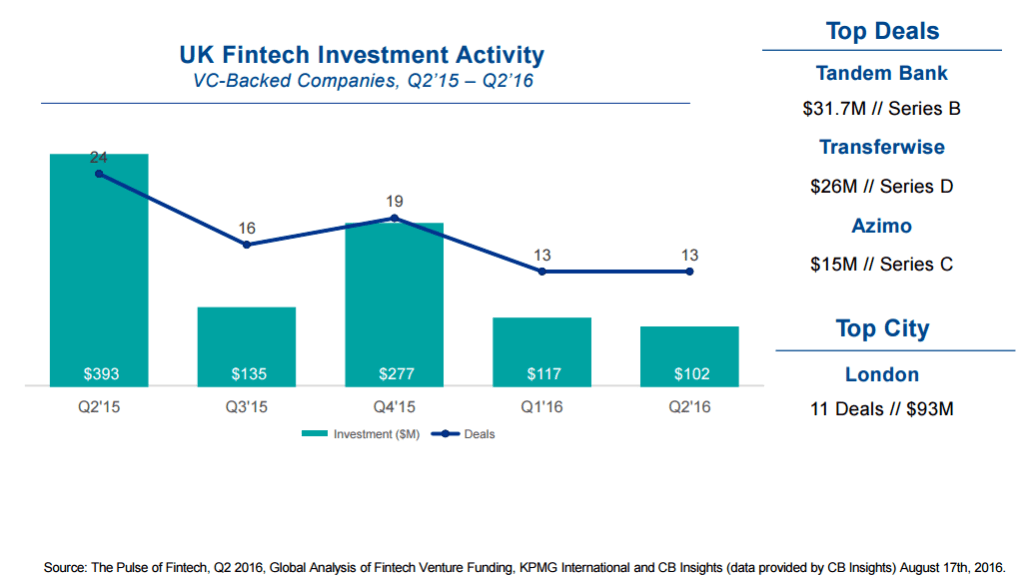

The number of UK deals maintained a steady pace quarter-on-quarter while total deal value decreased slightly from $117m to $103m. Regardless of Brexit, the report adds, the UK will not give up its role as a FinTech leader in Europe easily, demonstrated by the country’s regulatory sandbox and its announcement of a FinTech bridge with Singapore, which will seek to make it easier for UK-based FinTech firms to operate in that country and vice versa.

Despite the decline, the research shows that funding is currently on pace to surpass last year’s investment levels,but it warns that the ‘cooling-off’ period is expected to last throughout the rest of the year as investors continue to take a ‘wait and see’ approach in hope of seeing greater market stability in the next few months. Although some VCs will probably remain cautious, the report highlights that many Banks, financial institutions and insurance companies are going ahead with FinTech-related activities whether through direct investment, acquisition or the creation of innovation labs.

According to the report, the US continued to dominate venture capital deals in the FinTech market; accounting for $1.3bn out of the total $2.5bn raised throughout the quarter.

Source: VC investment in German FinTech ‘outpaced UK by 80%’ in Q2 2016 | Tech City News

Leave a Reply